More About Clark Wealth Partners

Table of ContentsAbout Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.What Does Clark Wealth Partners Mean?Excitement About Clark Wealth PartnersThe smart Trick of Clark Wealth Partners That Nobody is DiscussingSome Known Incorrect Statements About Clark Wealth Partners 8 Easy Facts About Clark Wealth Partners ExplainedThe Greatest Guide To Clark Wealth Partners

Typical factors to think about a financial expert are: If your financial scenario has come to be much more intricate, or you lack confidence in your money-managing skills. Conserving or browsing significant life events like marriage, divorce, kids, inheritance, or work modification that may significantly affect your financial situation. Browsing the change from conserving for retired life to protecting riches throughout retirement and how to create a solid retired life earnings strategy.New innovation has led to more detailed automated financial devices, like robo-advisors. It's up to you to examine and determine the best fit - https://yamap.com/users/4963188. Ultimately, a great monetary expert must be as mindful of your investments as they are with their very own, avoiding excessive costs, conserving money on taxes, and being as transparent as feasible regarding your gains and losses

The 6-Second Trick For Clark Wealth Partners

Gaining a commission on item suggestions doesn't always imply your fee-based advisor functions against your ideal rate of interests. They may be more inclined to suggest products and solutions on which they gain a payment, which may or may not be in your finest rate of interest. A fiduciary is legitimately bound to put their customer's rate of interests initially.

They may adhere to a loosely monitored "suitability" standard if they're not registered fiduciaries. This typical permits them to make suggestions for financial investments and services as long as they suit their customer's goals, risk tolerance, and financial circumstance. This can convert to referrals that will likewise gain them cash. On the various other hand, fiduciary consultants are lawfully bound to act in their client's ideal interest instead of their very own.

How Clark Wealth Partners can Save You Time, Stress, and Money.

ExperienceTessa reported on all points investing deep-diving into complicated economic topics, clarifying lesser-known investment methods, and discovering ways viewers can work the system to their benefit. As a personal financing expert in her 20s, Tessa is really familiar with the impacts time and uncertainty carry your financial investment choices.

It was a targeted promotion, and it worked. Learn more Check out less.

A Biased View of Clark Wealth Partners

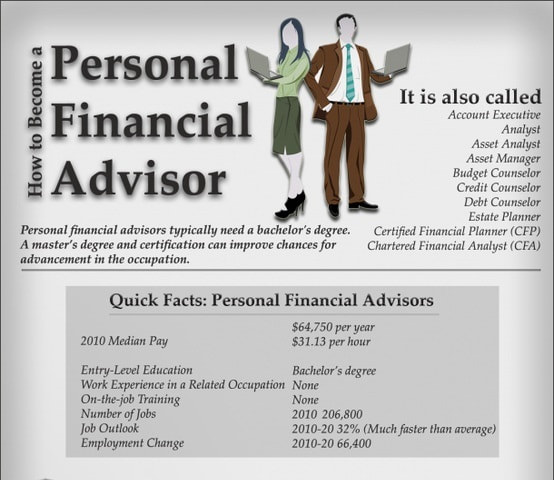

There's no single route to coming to be one, with some individuals beginning in financial or insurance coverage, while others begin in audit. A four-year level provides a solid structure for occupations in investments, budgeting, and customer services.

How Clark Wealth Partners can Save You Time, Stress, and Money.

Usual instances consist of the FINRA Series check here 7 and Series 65 exams for safety and securities, or a state-issued insurance coverage license for selling life or medical insurance. While credentials may not be legally needed for all preparing functions, companies and customers commonly watch them as a standard of professionalism. We take a look at optional credentials in the next area.

A lot of financial coordinators have 1-3 years of experience and experience with economic products, conformity standards, and straight client communication. A solid academic background is necessary, however experience shows the capacity to apply theory in real-world settings. Some programs combine both, enabling you to finish coursework while making supervised hours through internships and practicums.

The Best Strategy To Use For Clark Wealth Partners

Early years can bring long hours, stress to develop a client base, and the requirement to continuously confirm your competence. Financial organizers take pleasure in the possibility to work closely with clients, overview important life decisions, and usually achieve versatility in schedules or self-employment.

Riches supervisors can enhance their incomes with payments, property fees, and performance benefits. Economic managers oversee a team of financial coordinators and advisors, setting department strategy, taking care of compliance, budgeting, and directing internal procedures. They spent less time on the client-facing side of the industry. Virtually all economic supervisors hold a bachelor's level, and several have an MBA or comparable academic degree.

Clark Wealth Partners - An Overview

Optional certifications, such as the CFP, commonly need additional coursework and screening, which can expand the timeline by a couple of years. According to the Bureau of Labor Statistics, individual financial advisors gain a mean yearly annual salary of $102,140, with top income earners gaining over $239,000.

In other districts, there are policies that need them to fulfill specific demands to make use of the monetary consultant or economic coordinator titles (financial planner in ofallon illinois). What establishes some economic consultants in addition to others are education and learning, training, experience and qualifications. There are many classifications for economic experts. For financial organizers, there are 3 common designations: Licensed, Individual and Registered Financial Planner.

Rumored Buzz on Clark Wealth Partners

Where to discover a financial consultant will certainly depend on the type of advice you need. These institutions have team who may aid you comprehend and purchase certain types of financial investments.